Divorce 101: F Is for Financial Disclosure (and February)

February has a reputation for being about love—roses, chocolates, grand gestures. But in the world of divorce, February often marks something quieter and far more practical: clarity. That’s why this month, in our Divorce 101 A to Z series, F is for Financial Disclosure.

Financial disclosure is the process of openly sharing all financial information during a divorce. Bank accounts. Credit cards. Retirement funds. Debts. Income. Assets. The unglamorous, spreadsheet-heavy reality of how a household actually functioned. And while it may not feel romantic, financial disclosure is one of the most loving acts you can offer yourself during a divorce.

Here’s the truth: divorce decisions are only as fair as the information they’re based on. Without full disclosure, negotiations stall, mistrust grows, and people are left making life-altering decisions in the dark. Financial disclosure isn’t about “catching” someone—it’s about creating a shared set of facts so that resolution can actually happen.

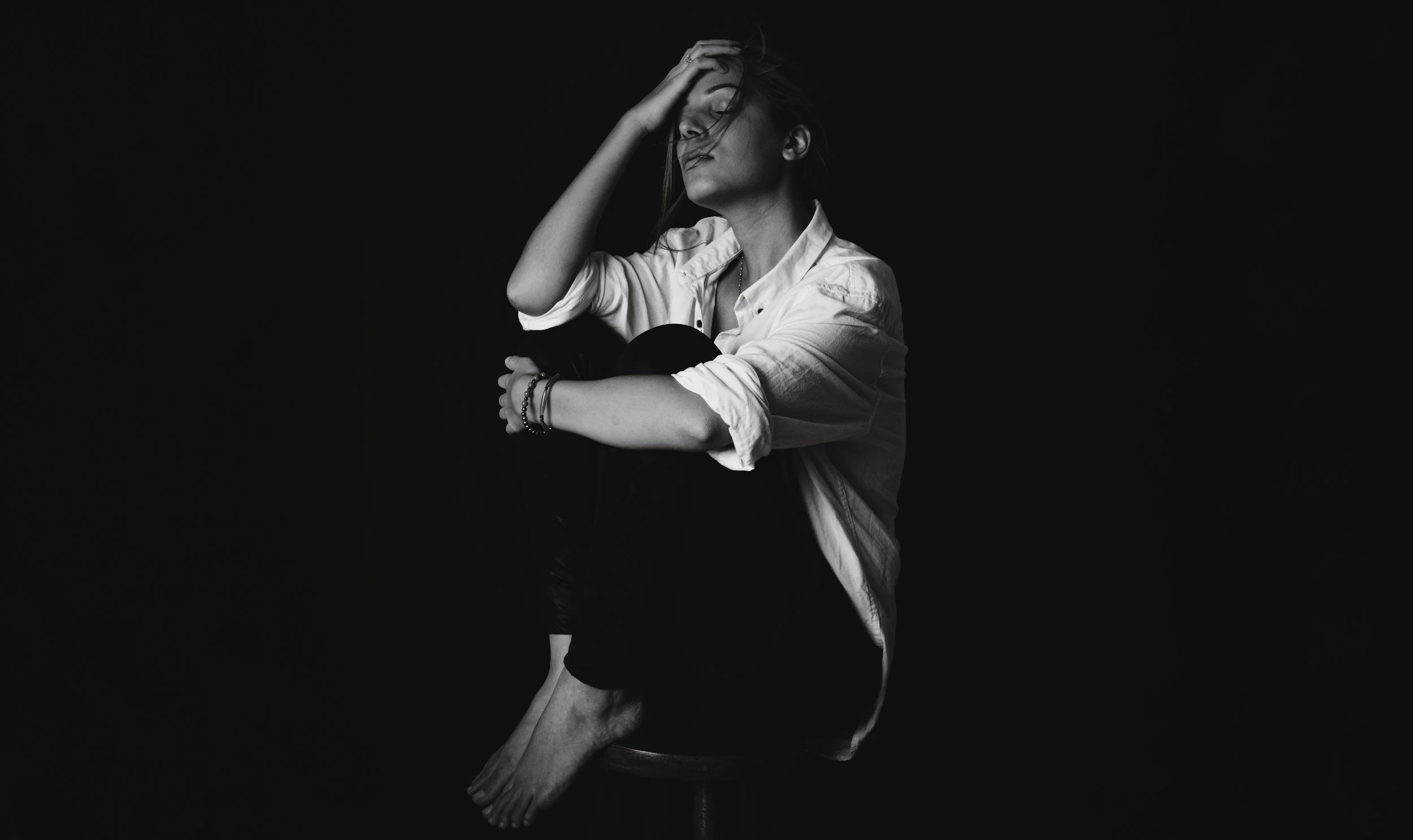

February is a fitting backdrop for this conversation because it’s a transitional month. We’re no longer at the beginning of the year, but we’re not fully settled into it either. That mirrors where many people are emotionally when divorce becomes real: no longer pretending everything is fine, but not yet sure what comes next. Financial disclosure sits right in that in-between space. It’s uncomfortable—but it’s clarifying.

If you’re navigating divorce right now, think of financial disclosure as a form of self-respect. Gathering documents, asking questions, and understanding your financial landscape doesn’t make you difficult—it makes you informed. And information is power, especially when you’re rebuilding.

So this February, instead of focusing on what’s been lost, consider what can be revealed. Because when finances are transparent, the path forward—while still hard—becomes clearer. And clarity, in divorce, is its own kind of love.

Listen to Divorce 101 now